Adblock test (Why?)

"some" - Google News

October 15, 2022 at 07:11PM

https://ift.tt/Yok7Aeb

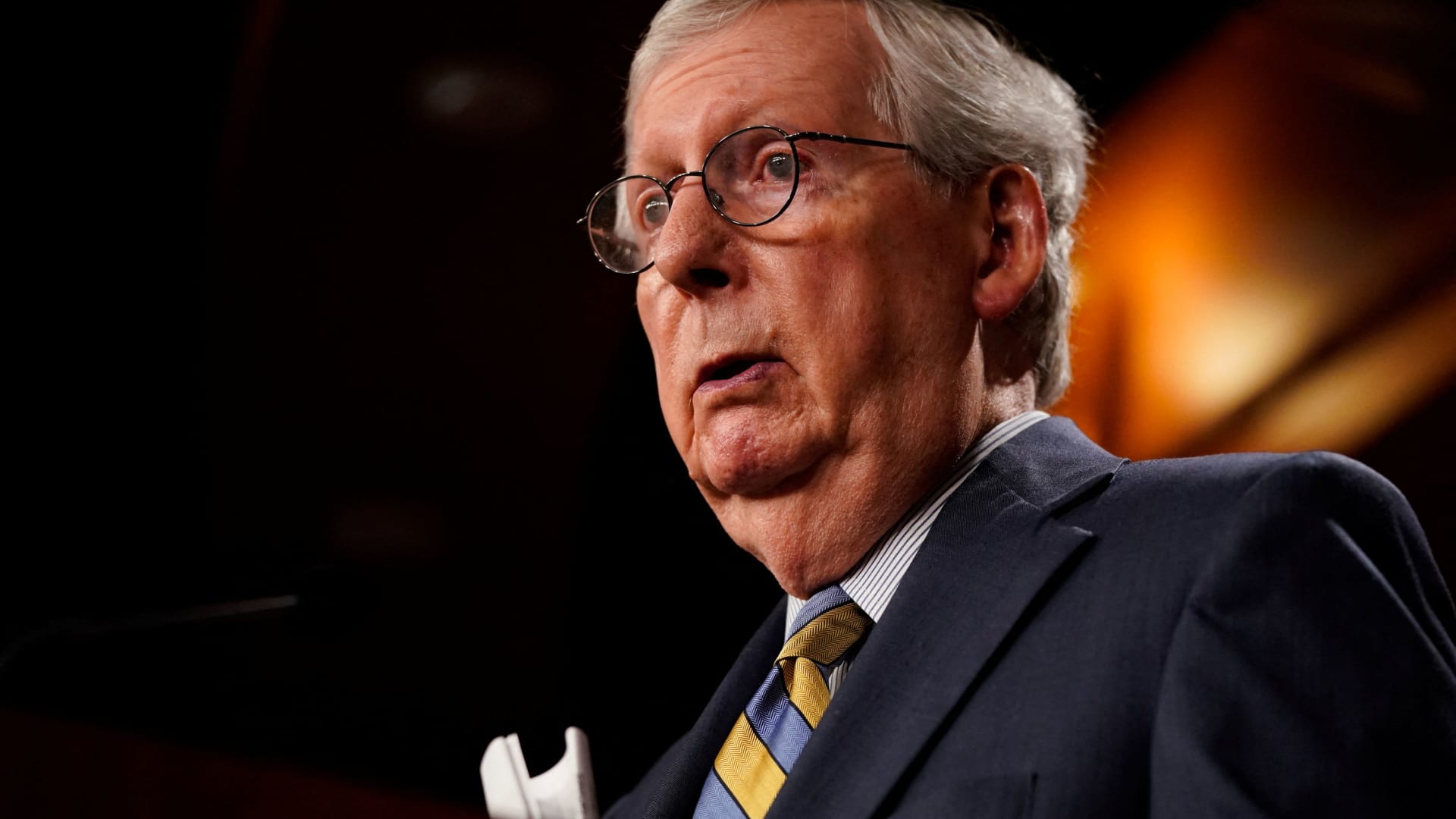

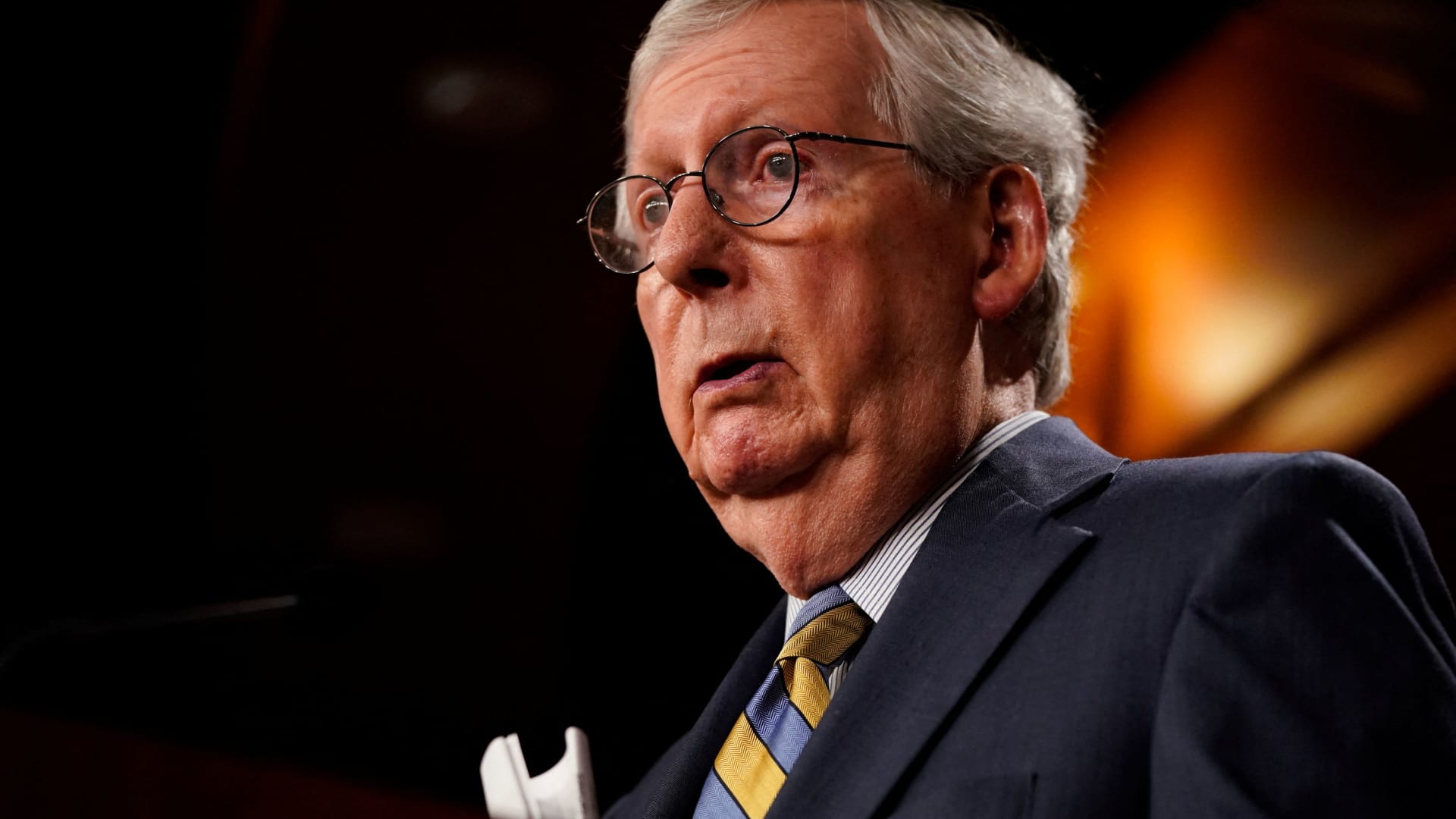

Stocks are giving some clues that there could be a Republican congressional sweep, Strategas says - CNBC

"some" - Google News

https://ift.tt/5pZmJ37

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Stocks are giving some clues that there could be a Republican congressional sweep, Strategas says - CNBC"

Post a Comment