(Bloomberg Opinion) -- Exchange-traded funds that cater to environmental, social and governance principles are being pitched as a way for investors to sleep with peace of mind, but they better be prepared to wake up with something less than dreamy returns.

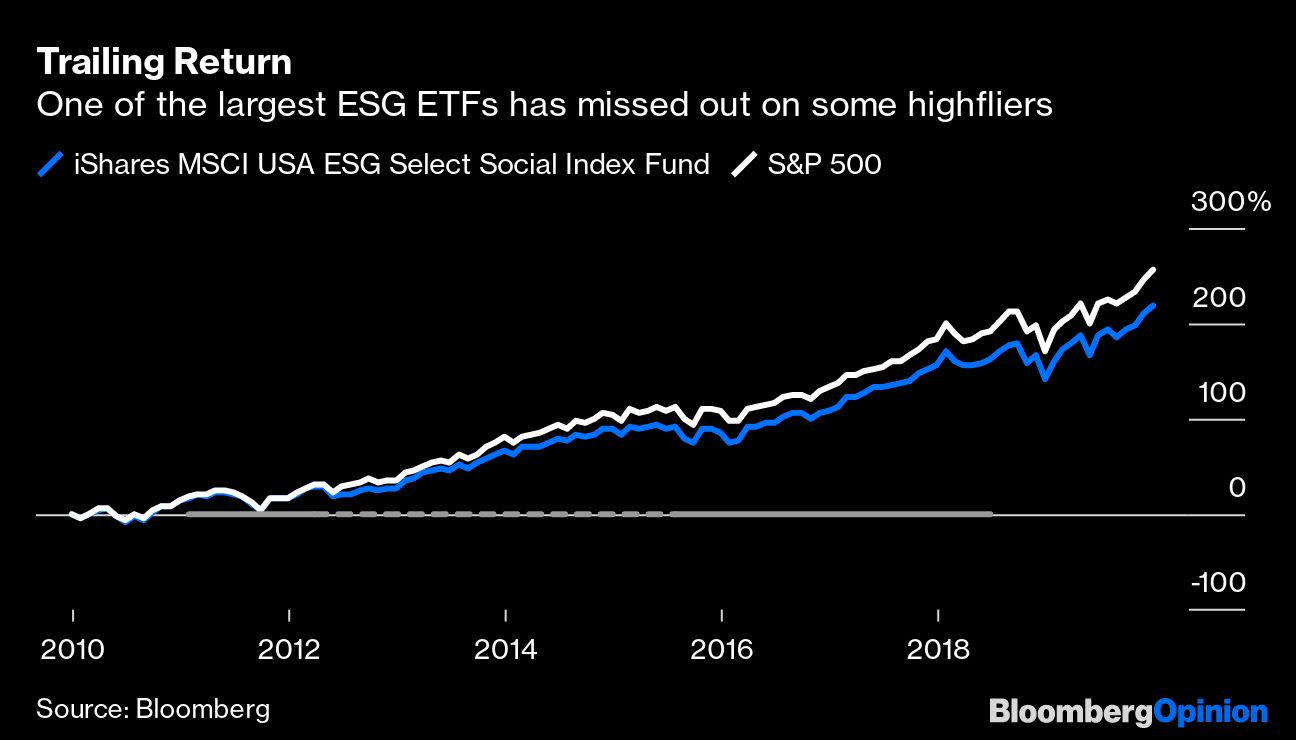

Consider the iShares MSCI USA ESG Select Social Index Fund (SUSA), one of the oldest and largest ESG ETFs on the market. SUSA, which tracks the 100 stocks with the highest ESG ratings, has trailed the S&P 500 Index by 37 percentage points during the past 10 years.(1) (I honed in on SUSA because it has a long-term track record. Most ESG ETFs are very new.) The reason it lagged taps into one of the most important yet underreported aspects of ESG funds: surprising exclusions.

While some of the stocks excluded from SUSA are obvious, such as Exxon Mobil Corp. and Lockheed Martin Corp., some are less obvious, such as Amazon.com Inc., Netflix Inc., Ross Stores Inc. and Mastercard Inc. — all of which are up more than 1,000% during the past 10 years. Not having stocks like these is why SUSA couldn’t keep up with the overall market. Not to pile on here, but SUSA’s underperformance also came with a higher standard deviation, or level of volatility.

This potential for underperfomance is why I think investors should take what I call “The Amazon Test” before buying an ESG ETF. It has two parts. The first is to simply ask whether you are willing to miss out on the next Amazon to “clean up” your portfolio. Or even better, if you want to do the leg work, compare the ESG ETF’s holdings to the appropriate broad index and comb through the differences. You may be surprised by what is included in the ETF. (In SUSA’s case, it does hold Facebook Inc. and Nike Inc., which many may find questionable.) I can guarantee investors will probably be a bit baffled.

Of course it’s possible that the next Amazon is already in your ESG ETF and that the fund outperforms the market and everyone’s happy. SUSA could very well beat the market during the next 10 years. But investors need to be ready in case it doesn’t.

I was curious how people would respond to this question, so I ran an informal Twitter poll and found that only a fifth of people were both interested in ESG and satisfied with missing the next Amazon. That means more than half of ESG-interested investors did not want to miss out on an Amazon, which tends to be excluded from ESG funds because of working conditions that put it on a worker-rights group’s “Dirty Dozen” list of the most dangerous employers in the U.S.

Of course, not only highfliers are excluded from many ESG ETFs; so are some of the country’s most revered companies, which many people probably want to own. The best example is Warren Buffett’s Berkshire Hathaway Inc., which is included in fewer ESG ETFs than Exxon and is practically excluded from all of them. It’s the second-lowest-ranked company by Sustainalytics(2) among the S&P 100 Index. Essentially, investors can have ESG or Buffett, but not both.

So why is Buffett, one of the greatest investors and philanthropists the world has ever seen, not in these funds? One big reason is Berkshire’s board is only 57% independent, well below the 86% average. Buffett has signaled no intention of changing the company’s business practices. He implied the independent board is a poor metric, saying many such boards he has been on are independent on paper only, with many directors just looking for a payday and typically following the CEO’s lead. Buffett has also said he doesn’t want to burden subsidiary companies, one of which operates coal-fired plants, with unnecessary rules and costs.

“We’re not going to spend the time of the people at Berkshire Hathaway Energy responding to questionnaires or trying to score better with somebody that is working on that. It’s just, we trust our managers and I think the performance is at least decent and we keep expenses and needless reporting down to a minimum at Berkshire.”

Some have pushed back, saying that “surprising exclusions” are nothing new and exist in other areas such as smart-beta and theme ETFs. This is true, but there is one crucial difference: Those ETFs aren’t generally seeking to replace an investor’s entire equity portion of the portfolio. Because if the goal is to “sleep at night,” then what’s the point of putting a small allocation into an ESG ETF while still investing in other funds, like the Vanguard 500 Index Fund, which hold those “bad” companies you don’t want?(3)

For those who are interested in ESG and don’t mind missing out on the next Amazon, the next part of my test is to ask whether they are willing to curb their consumption of the goods and services provided by those excluded companies. For example, are you going to continue to shop at Amazon, drive an SUV or take airplanes 10 times a year? If so, then what’s the point of not owning those stocks? You are just going to rob yourself of profits you helped create.

I did an informal poll on this, too, and found only a fifth of those who were willing to miss out on Amazon were also willing to not shop there. Now, I’m not saying you need to live in the woods and eat bugs to be pure enough to be an ESG investor, but you should probably be willing to make some inconvenient choices as a consumer — because, let’s be honest, that’s where investors can truly make a company pay attention. Otherwise, a lot of this is demand trying to demonize supply to soothe its guilt and feel good inside.

At the end of my little screening system here we are left with 5% of the investing world that I’d argue has the stomach and commitment to be messing around with ESG ETFs.(5) The rest either just don’t want ESG or are slacktivists — people who want to feel as if they are doing something but are unwilling to make any inconvenient sacrifices such as lagging the market or curbing parts of their lifestyles. These investors should probably just stick with owning the broad market.

And while 5% may seem like a small amount, it would actually be a pretty solid base of investors for these ETFs. To convert that into dollars, 5% of ETF assets would equate to $200 billion, a respectable category. Currently, ESG ETFs have only about one-tenth of that amount. And yet there are about 100 products on the market. That’s $200 million per ETF, which is five to 10 times below the average of many other popular areas. Supply has so far outpaced the hype and demand in a way that’s never been seen in the ETF market.

And it doesn’t look as if product proliferation will be slowing anytime soon. BlackRock’s Larry Fink recently announced a doubling of the company’s ESG ETF lineup, which means due diligence will be that much more cumbersome.

And while this may come off as a bit of a downer to all the excitement around ESG, that’s not my intention. I’m not anti-ESG at all, but I am anti-nasty surprise.

I just want to help make sure investors wake up with peace of mind, too.

(1) SUSA has also lagged since inception in 2005 by 33% and by 4% over the past 5 years, though it is outperforming by 1% over the past year. And to show I'm not cherry-picking, the other veteran ESG ETF, the iShares MSCI KLD 400 Social ETF (DSI), has lagged the market by 30 percentage points over the past 10 years.

(2) An equal-weighted basket of the 20 stocks in the S&P 100 with the lowest Sustainalytics Ranking outperformed the S&P 500 Index by 41% over the past seven years. Sustainalytics is an ESG research and ratings platform whose scores are used on the Bloomberg Terminal.

(3) Now, if investors are seeking ESG ETFs because they think there is some premium to capture that can add alpha to their portfolios and they are only allocating a little, then there is less need for this test (although you can never go wrong with looking under the hood of a fund). But largely, ESG ETFs are being pitched and talked about as a “sleep at night” replacement, or a way to support companies that align with investors’ values.

(4) Add in the fact that most people don’t know what ESG even stands for, let alone how the scoring systems (which all vary by the way) work, and you get a situation where the product proliferation and hype has far outpaced the education needed to use them.

To contact the author of this story: Eric Balchunas at ebalchunas@bloomberg.net

To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Eric Balchunas is an analyst at Bloomberg Intelligence focused on exchange-traded funds.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

"some" - Google News

January 27, 2020 at 06:00PM

https://ift.tt/36wi7nw

Socially Conscious ETFs Have Some Baffling Holes - Yahoo Finance

"some" - Google News

https://ift.tt/37fuoxP

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Socially Conscious ETFs Have Some Baffling Holes - Yahoo Finance"

Post a Comment