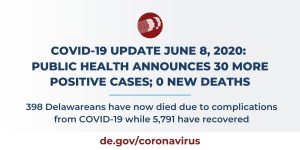

Read the latest news on coronavirus in Delaware. More Info

Refunding transaction helps address the State’s budget challenges

WILMINGTON, Del. – The State of Delaware today announced the successful refunding of $33 million of debt at a record low Total Interest Cost of 0.79%. The transaction will save the State $5.2 million in debt service on a net present value basis over the next decade and is structured to further help the State address the Fiscal Year 2021 budget challenges brought on by the COVID-19 emergency.

Three bond rating agencies reaffirmed Delaware’s Triple A rating – Fitch, Moody’s and KRBA – with each taking note of the work of Governor John Carney and the Delaware General Assembly in recent years to boost reserves to prepare for economic downturns. J.P. Morgan Securities LLC served as senior managing underwriter for the transaction.

View rating agencies’ credit reports.

“Delaware continues to receive high marks for fiscal management which allows us to sustain the important investments we’ve made in our schools, our communities and our economy, including efforts to address the impacts of COVID-19,” said Governor John Carney. “The COVID-19 emergency presents enormous financial challenges for every state including Delaware. But I think all Delawareans can be proud of the work we’ve done with the General Assembly to boost the State’s finances prior to this unanticipated event, so our State is better prepared to weather the storm.”

“This successful transaction shows the market’s confidence in Delaware despite the near-term challenges faced by every state,” said Secretary of Finance Rick Geisenberger. “The competitive pricing and debt service savings achieved for Delaware’s taxpayers speak volumes about our State’s continuing financial strengths.”

KRBA views the financial position of the State as “very strong based on its conservative budgeting policies, comprehensive and timely process of revenue estimation, high levels of financial reserves and strong liquidity. In response to the economic impacts of pandemic, the State has constrained its FY2020 spending and projected expenditures are under budget.”

Moody’s noted that “Delaware’s Aaa rating is supported by its healthy and stable finances and its strong management and governance, all of which enhance the state’s capacity to weather the economic downturn caused by the coronavirus outbreak. The state’s recent growth in reserves provide a cushion in the currently challenged economic environment brought on by the coronavirus pandemic.”

Fitch also noted that “Delaware’s history of exceptional financial resilience and strong budget management may be tested by the depth and duration of this downturn. However, Delaware’s close tracking of both revenues and expenditures and frequent revenue forecasts updates have historically allowed it to quickly respond to changing economic conditions. Fitch anticipates the state will take appropriate action to maintain balance.”

###

Related Topics: bond, credit rating, finance, fiscal responsibility, Responsible Investment

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

Refunding transaction helps address the State’s budget challenges

WILMINGTON, Del. – The State of Delaware today announced the successful refunding of $33 million of debt at a record low Total Interest Cost of 0.79%. The transaction will save the State $5.2 million in debt service on a net present value basis over the next decade and is structured to further help the State address the Fiscal Year 2021 budget challenges brought on by the COVID-19 emergency.

Three bond rating agencies reaffirmed Delaware’s Triple A rating – Fitch, Moody’s and KRBA – with each taking note of the work of Governor John Carney and the Delaware General Assembly in recent years to boost reserves to prepare for economic downturns. J.P. Morgan Securities LLC served as senior managing underwriter for the transaction.

View rating agencies’ credit reports.

“Delaware continues to receive high marks for fiscal management which allows us to sustain the important investments we’ve made in our schools, our communities and our economy, including efforts to address the impacts of COVID-19,” said Governor John Carney. “The COVID-19 emergency presents enormous financial challenges for every state including Delaware. But I think all Delawareans can be proud of the work we’ve done with the General Assembly to boost the State’s finances prior to this unanticipated event, so our State is better prepared to weather the storm.”

“This successful transaction shows the market’s confidence in Delaware despite the near-term challenges faced by every state,” said Secretary of Finance Rick Geisenberger. “The competitive pricing and debt service savings achieved for Delaware’s taxpayers speak volumes about our State’s continuing financial strengths.”

KRBA views the financial position of the State as “very strong based on its conservative budgeting policies, comprehensive and timely process of revenue estimation, high levels of financial reserves and strong liquidity. In response to the economic impacts of pandemic, the State has constrained its FY2020 spending and projected expenditures are under budget.”

Moody’s noted that “Delaware’s Aaa rating is supported by its healthy and stable finances and its strong management and governance, all of which enhance the state’s capacity to weather the economic downturn caused by the coronavirus outbreak. The state’s recent growth in reserves provide a cushion in the currently challenged economic environment brought on by the coronavirus pandemic.”

Fitch also noted that “Delaware’s history of exceptional financial resilience and strong budget management may be tested by the depth and duration of this downturn. However, Delaware’s close tracking of both revenues and expenditures and frequent revenue forecasts updates have historically allowed it to quickly respond to changing economic conditions. Fitch anticipates the state will take appropriate action to maintain balance.”

###

Related Topics: bond, credit rating, finance, fiscal responsibility, Responsible Investment

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

"triple" - Google News

June 09, 2020 at 10:27PM

https://ift.tt/30ow0Vh

Delaware's Triple-A Bond Ratings Reaffirmed - news.delaware.gov

"triple" - Google News

https://ift.tt/3dc0blF

https://ift.tt/2WoIFUS

Bagikan Berita Ini

0 Response to "Delaware's Triple-A Bond Ratings Reaffirmed - news.delaware.gov"

Post a Comment